Author: Anjum Abdullah Tahha

Abstract:

The global apparel sector is facing a critical challenge: reducing its reliance on virgin polyester, which contributes to environmental degradation and microplastic pollution. Just over forty percent waste which is more than 87,000 tons of PET bottle waste produced annually in Bangladesh, the second-largest exporter of clothing worldwide, is recycled, primarily through low-value methods. This paper will make you think of a new approaches for Bangladesh to lead the sustainable polyester revolution through recycling technology, biodegradable polyester R&D, and policy-driven incentives. It will draw attention to how domestic bottle-to-fiber facilities, public-private partnerships, and circular economy frameworks might support SDGs 12 and 13 and global trends. Also this article will give us the idea to make Bangladesh as a leader in sustainable textile manufacturing by 2030 through in-depth analysis with data-driven insights, and workable roadmaps.

Introduction

Have you ever stopped to think where your fancy drink bottles or even the plastic bottles of yours actually go??? No right! Every year, Bangladesh pull over 87,000 tons of PET bottle waste and most of it ends in landfills, rivers, or burned in open spaces. These discarded bottles, once holding water or soft drinks, silently contributing in clogged drains, urban flooding, and an escalating plastic pollution crisis. At the same time our country’s Ready-Made Garments (RMG) industry, contributing nearly 84% of export earnings which heavily depends on virgin polyester, a petroleum-based fiber that is neither biodegradable nor circular. Interesting right?

This dichotomy, where mountains of plastic trash and an ever-growing need for synthetic fibers coexist, presents a high grabbing unique opportunity for Bangladesh.. By converting waste into high-value recycled polyester and investing in the innovation of biodegradable alternatives which can make Bangladesh itself as a global leader in sustainable textiles.

We will see how innovative ways we can break the polyester loop, from advanced recycling technologies and biodegradable polymer research to policy-driven incentives and circular economy models. But here’s the question we must ask ourselves!

Is it a worldwide issue or just ours?

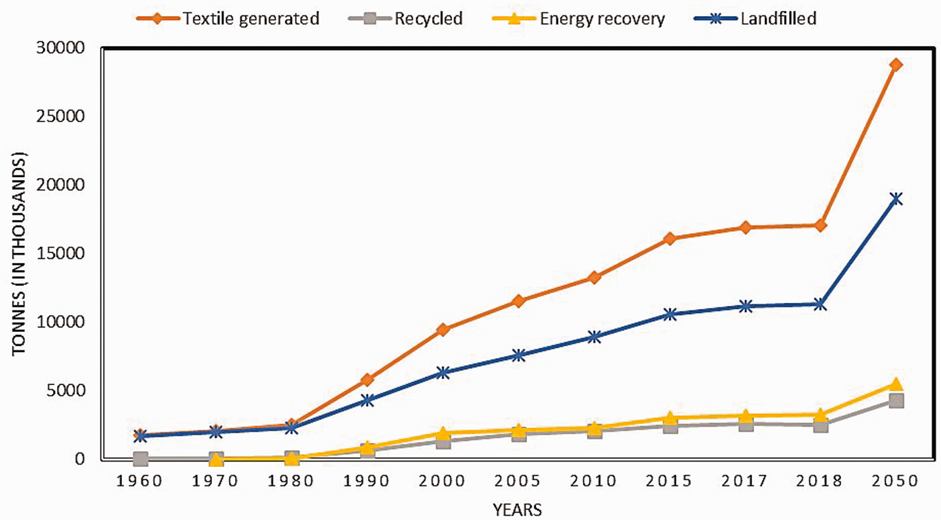

The problem with polyester is not specific only for Bangladesh but also it is a worldwide issue that is intertwined with contemporary fashion. Global fiber production increased from 116 million tonnes in 2022 to 124 million tonnes in 2023, and by 2030, it is predicted to reach 160 million tonnes which will increase day by day and in that About 70 to 75 million tonnes of polyester alone, or 57% of that volume, are made up of virgin, fossil-based fibers which is a lot of waste.

The recycling rate is still incredibly low. Information from Textile Exchange 2024 research says, 87% of polyester is now non-circular, with recycled polyester (rPET) falling from 13.6% in 2022 to just 12.5% in 2023. Even worse like my hairline, 35% of the 1.5 million tonnes of microplastics that end up in the world’s oceans each year come from synthetic fabrics.

A detailed chart shows about the whole part of this section is given under below

Even industry giants like China and Vietnam is also facing this similar recycling bottlenecks but for Bangladesh it is quit difficult. But yes! it can be easily handled with technical and strategic solutions. Now its time to step into the Sustainable Industry

Current Scenario & Market Overview

Bangladesh, the world’s second-largest producer of ready-made garments (RMG), generated more than $47 billion in apparel exports in 2024, with polyester-based fabrics accounting for over 25% of production while cotton continue to dominate at approximately 75%. However Bangladeshs substantial reliance on imported virgin polyester worth more than $2 billion per year is a lot, primarily from China and India demonstrates its reliance on non-circular supply chains. Where BD generates around 87,000 tons of PET bottle waste each year, with just 36-40% recycled. And other is lost in money and lost in gold!

If we focus on the global perspective of this sector we will see a lot growth is going on day by day and which wont stop because of the high demand of plastic.

Which shows the plastic waste management market will rise upto 46.8B dollar in 2030 and the recycled polyester market is about 26.2B dollar by 2030!

Global clients such as H&M, Zara, Adidas, and Patagonia are tightening their sustainability criteria, and with EU and US trade policies requiring verifiable circularity by 2027, the impetus to use traceable recycled polyester and biodegradable alternatives has never been greater. Leveraging even 25% of domestic PET trash through advanced recycling might earn $400-500 million per year, cementing Bangladesh’s position as a significant player in the $15 billion worldwide recycled polyester market forecast for 2030.

Innovation & Solutions

Solving this problem world wide and specially in respect Bangladesh’s it demands a holistic innovation framework built on infrastructure, R&D, digitalization, and skill development. Each pillar must work together to transition the industry from a linear “produce-use-dispose” model to a circular economy.

Industrial-Scale Bottle-to-Fiber Recycling

Bangladesh needs to build cutting-edge depolymerization and melt-to-yarn facilities capable of processing massive amounts of PET. Currently, about 87,000 tons of PET waste are generated annually, but less than 40% is recycled, frequently into low-value items. The country might deploy three to four modern facilities with a combined capacity of 25,000 to 30,000 tons per year.

- Produce $400–500 million annually from domestic rPET yarn production.

- Reduce reliance on $2 billion worth of imported virgin polyester, saving $100–150 million each year.

- Create 10,000+ green jobs.

This transition can be accelerated by public-private partnerships, green investment funds, and incentives from organizations such as IDCOL, IFC, and the Asian Development Bank. Vietnam’s experience with REPREVE® yarn production provides a reliable baseline for Bangladesh to follow.

Biodegradable Polyester R&D and Pilot Programs

Innovation must prioritize next-generation biodegradable polyesters, such as:

PLA-PET hybrids – bioplastics combined with recycled polyester for better breakdown.

Enzymatic depolymerization is the process of breaking down polymers with biotech solutions at a lower energy cost.

Chemical recycling advances by incorporating glycolysis or methanolysis technology.

Local universities such as BUTEX, in collaboration with global research hubs in Japan and Germany, can spearhead pilot programs. These inventions have the potential to reduce microplastic pollution by 60-70% while also creating high-margin export markets for eco-certified clothes.

Digital Traceability and Supply Chain Transparency

Global buyers are expecting complete traceability. Manufacturers track every stage of the manufacturing process by using blockchain-based systems, from bottle collection to yarn spinning to garment completion. This not only boosts customer confidence, but also places Bangladesh as a leader in transparent.

Branding and Market Positioning

Finally, in order to increase its worldwide market share for Bangladesh we must invest in promoting sustainable polyester as a national innovative identity and make the “Made in Bangladesh — Green Fiber Certified” tags on garments sold in New York, London, and Tokyo. This strategic run can combine with validated ESG criteria, can attract a 10-15% price premium in global marketplaces higher profit.

Global Benchmarks & Case Studies

Global pioneers in sustainable polyester have already demonstrated that circular innovation is both viable and profitable. By studying these pioneers, Bangladesh can speed up its transformation and avoid the pitfalls of trial and error.

Global pioneers prove that circular polyester innovation isn’t just possible — it’s profitable.

- Patagonia – Uses 90% rPET with full traceability since the ’90s.

“Everything manufactured pollutes. The best we can do is minimize the harm and innovate for the planet.”

~Yvon Chouinard, Founder

Lesson: Build transparency and brand trust early. - Stella McCartney – Invests heavily in biodegradable polyester R&D with biotech firms.

“Sustainability isn’t a trend; it’s a responsibility. Innovation is our path forward.”

~Stella McCartney, Designer

Lesson: Partner globally to fast-track innovation. - China – Produces 70% of global polyester and operates large-scale recycling hubs.

“Scale without sustainability is no longer an option in global textiles.”

~Zhejiang Jiaren Executive

Lesson: Scale infrastructure with quality control and compliance. - Vietnam – Collaborates with brands like REPREVE®, capturing 15% rPET export share.

“Collaboration drives transformation; we grow when we innovate together.”

~UNIFI Asia Pacific Leader:

Lesson: Form joint ventures to secure funding and guaranteed demand.

Bangladesh’s Opportunity

For Bangladesh, the polyester crisis serves as a stimulus for transformation. With 87,000 tons of PET waste produced each year and a $2 billion reliance on virgin polyester, investing in local recycling, biodegradable R&D, and transparent supply chains has the potential to turn waste into wealth by creating green jobs, attracting global buyers, and positioning Bangladesh as a textile sustainability leader. Even if we look at the global market in consumer we will see:

Which says Bangladesh have a huge opportunity in this sector that can brand Bangladesh in the word economy too.

Impact & Future Vision

If Bangladesh adopts a circular polyester ecosystem, the benefits will be economic, social, environmental, and market-driven. Economically, rPET might earn $2-3 billion yearly while saving $250 million on imports. Socially, this transition might result in over 50,000 green employment in recycling, R&D, and manufacturing. Environmentally, it would minimize microplastic leakage by up to 70%, in line with SDGs 12 and 13. In the global market, it would boost Bangladesh’s position, allowing for 10-15% greater margins and pave the road to become a sustainability leader by 2030.

Before implementation After implementation

Implementation Challenges & Strategic Recommendations

Challenges include limited recycling infrastructure, expensive startup costs, talent gaps, ineffective policy enforcement, and poor consumer awareness.

Recommendations: To stimulate scalable, sustainable growth, invest in industrial-scale recycling plants, provide tax breaks for green innovation, establish worker training programs, enforce circular economy rules, and foster public-private collaborations.

Conclusion

Bangladesh is at a watershed moment in which trash may become wealth or more than gold or diamond. By embracing recycling, investing in biodegradable technology, and promoting circular practices, the country can ensure economic growth, safeguard the environment, and position itself as a global leader in sustainable textiles by 2030.